What are the current fees?

The Grange Homeowners Association Fee for 2024 is:

- Houses – $120/year plus GST = $126.00

- Condo Units – $60.00/year plus GST = $63.00

The payment deadline for 2024 is March 15, 2024, with interest payable on the outstanding balance thereafter at a rate of the Bank of Canada Prime Rate plus five percent, as per the encumbrance on all GHOA properties. A final reminder letter will be sent to those remaining in arrears after April 15th, 2024 with collection action to Field Law commencing May 15th, 2024.

Paying Online (via Rent Cafe/Condo Cafe):

You can pay your GHOA Annual fees online via Rent/Condo Cafe portal

- Portal access will be emailed to you by Ayre & Oxford at the email address you provide on the GHOA Registration Form. This portal will be used for paying fees and communications between the HOA and residents going forward.

Should you have any questions or concerns regarding payments, please contact Ayre & Oxford Inc. at 780-448-4984 Ext 335 or email agnes@ayreoxford.com

Please note: e-transfer is no longer a payment method we accept.

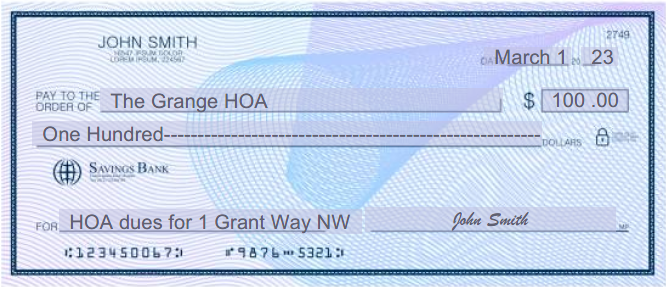

Paying by Cheque:

You can send a cheque or money order to the address listed on the invoice which is shown below payable to: The Grange Homeowners Association. Be sure to indicate your account number or address of the home you are paying the fee for within the memo section of the cheque so that we may ensure it gets applied to your account. Without this information, we may be unable to process payment.

Mail cheque to:

GHOA

c/o Ayre & Oxford Inc.

203, 13455 – 114 Avenue

Edmonton, AB T5M 2E2

The GHOA thanks you for keeping your account current. Please see the Projects Page for this years planned projects.

How and why Fees are charged

The Grange Homeowners Association (GHA) was established in early 2000 by the Developer to own, operate and maintain the common facilities of the Grange Community by registering an encumbrance against each lot and unit title in the Grange area. As such, all registered owners in the Grange area are members of The Grange Homeowners Association (GHA) and are bound by the obligations of the encumbrance.

At the beginning of each year, the elected Board of Directors of the GHA determines costs for ongoing community maintenance, administration, projects for the current year, and a reasonable reserve for future costs. A budget is established and the annual fee is set. Each property subject to the encumbrance, and by extension the current registered owner(s), receives notice of the fee set for the current year.

Why do we charge GST on Fees

In 2020, our Auditor for the fiscal year of 2019, Cass & Fraser Chartered Professional Accountants, determined that the GHA should collect/remit GST since GHA revenues had exceeded the $50K threshold. To ensure that we were doing everything correctly, and in the best interests of our members, the Board consulted our legal advisors at Parlee McLaws LLP. On their recommendation, we engaged BDO Canada LLP, whose tax attorney confirmed, that as a Homeowners Association, we were bound by CRA regulations to collect/remit GST. BDO also worked on our behalf to obtain our GST number, complete the necessary paperwork to CRA and determine any outstanding GST from prior years. As of this date (2022-02-01), we have not received an updated reconciliation from CRA. Funds have been reserved accordingly.